Since 1965

If you stop and think about it, banking has traditionally been pretty black and white. Not long ago, the most color you’d see from your banker was a dark gray suit, crisp white shirt, and the occasional burgundy tie.

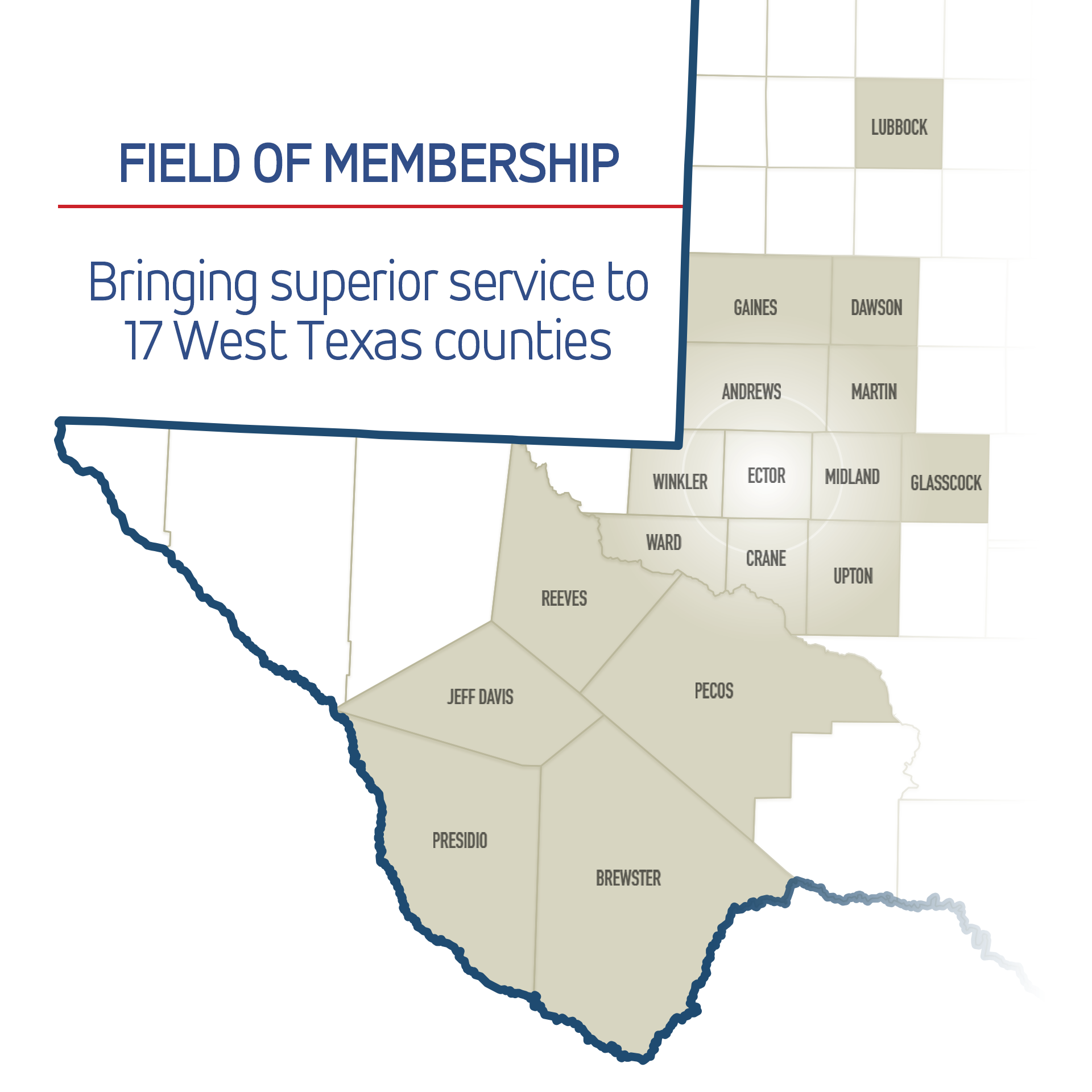

But in 1965, First Basin Credit Union set out to change that—with a mission to bring banking to life in full, vibrant color. We’ve always believed in doing more than just managing money. We help our members chase dreams, build futures, and live boldly.

Looking for a local bank that checks all the boxes? How about absolutely free checking, a credit card with a cape on it, instant issue debit cards, a powerful mobile app, a 4.8-star rating, free credit score monitoring with updates, and 7 locations?