Member Owned

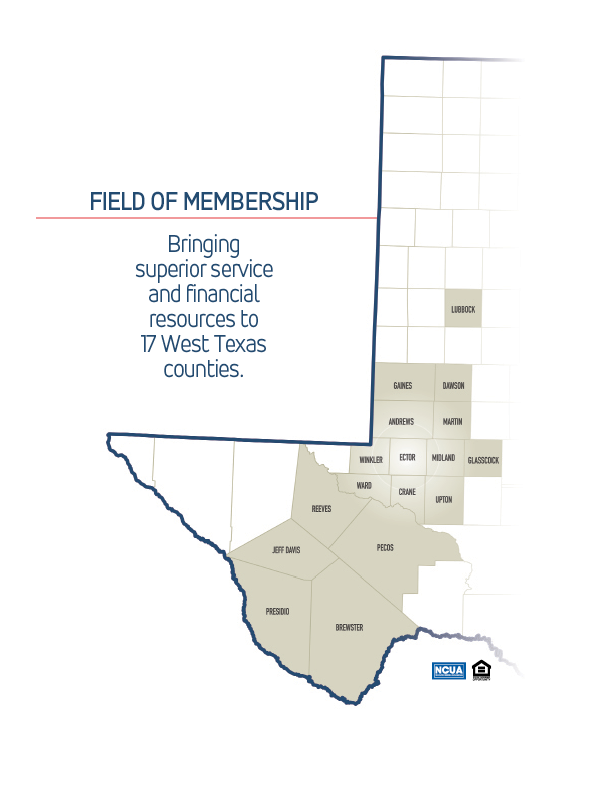

Credit unions are member-owned. Yes, that is correct – credit unions do not have stock holders, so when you open an account with a credit union, you become a “member” or part owner. Membership at a credit union is based on a common bond, also known as, a “field of membership”. Examples include a credit union for all educators or those in the medical field. At FBCU, we invite all those who live, work, worship or attend school in one of 17 West Texas counties to join our credit union.

To become a member at First Basin, we also require a $25 deposit into your savings account. That $25 is your buy-in to the credit union to become a member and part owner. However, that $25 does belong to you, so if you ever close your account to leave FBCU you can take your $25.

As part owners, members elect a board of directors to manage the credit union. Each year an annual meeting is held for board review and elections. Being a member-owned, not-for-profit organization, a credit union is operated on the principle of “people helping people”.

Not-for-Profit

Not-for-profit means that credit unions, FBCU included, operate to serve and promote the well-being of members. Profits made by credit unions are returned back to members through reduced fees, higher savings rates and lower loan rates.